Some Known Questions About Hard Money Atlanta.

Wiki Article

The Facts About Hard Money Atlanta Uncovered

Table of ContentsNot known Factual Statements About Hard Money Atlanta See This Report on Hard Money AtlantaNot known Details About Hard Money Atlanta The Hard Money Atlanta PDFsNot known Details About Hard Money Atlanta

These tasks are generally completed rapidly, for this reason the requirement for quick access to funds. Benefit from the job can be made use of as a down repayment on the following, therefore, tough money loans permit financiers to scale as well as turn more residential properties per time - hard money atlanta. Provided that the fixing to resale time structure is brief (generally much less than a year), house flippers do not need the long-term car loans that typical home mortgage loan providers offer.In this manner, the job has the ability to accomplish conclusion within the established timeline. Traditional loan providers may be thought about the reverse of tough cash lenders. So, what is a difficult money lender? Tough money lending institutions are normally private companies or private capitalists that use non-conforming, asset-based car loans primarily to real estate financiers.

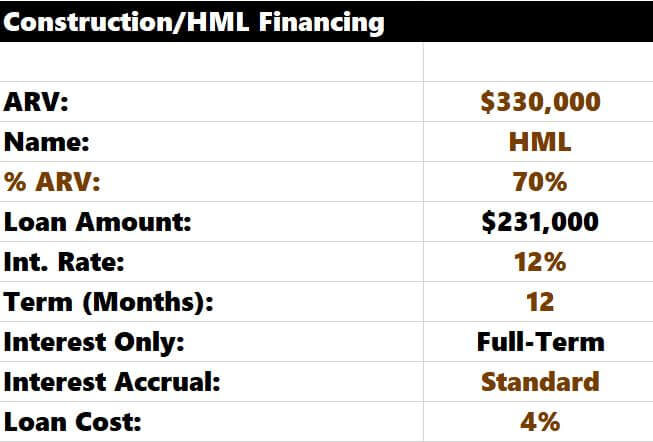

Normally, these variables are not the most vital factor to consider for car loan certification. Rate of interest prices may also differ based on the lending institution and also the bargain in question.

Difficult cash loan providers would likewise charge a charge for offering the loan, and also these charges are additionally recognized as "factors." They generally wind up being anywhere from 1- 5% of the total lending sum, nonetheless, points would usually equate to one percentage point of the finance. The significant distinction between a hard cash lending institution as well as other loan providers hinges on the approval procedure.

Hard Money Atlanta - An Overview

A difficult money lending institution, on the various other hand, concentrates on the property to be purchased as the top factor to consider. Credit report, income, and other specific requirements come additional. They likewise vary in regards to convenience of accessibility to funding and rate of interest prices; hard money lending institutions give moneying rapidly and charge higher rates of interest as well.You could discover one in among the following methods: A straightforward internet search Demand suggestions from regional realty agents Request recommendations from investor/ investor teams Since the fundings are non-conforming, you should take your time assessing the requirements as well as terms supplied prior to making a determined and informed choice.

It is necessary to run the numbers before going with a tough cash financing to make sure that you do not run into any loss. Obtain your tough money car loan today as well as get a finance commitment in 1 day.

These lendings can generally be gotten a lot more rapidly than a conventional financing, and frequently without a huge down repayment. A hard cash lending is a collateral-backed finance, protected by the real estate being bought. The dimension of the funding is identified by the estimated worth of the residential or commercial property after recommended repair work are made.

The Basic Principles Of Hard Money Atlanta

Many difficult cash car loans have a term of six to twelve months, although in some instances, longer terms can be arranged. The customer makes a regular monthly repayment to the loan provider, normally an interest-only repayment. Here's how a common hard money car loan works: The borrower wishes to purchase a fixer-upper for $100,000.

Keep in mind that some lending institutions will certainly need even more money in the deal, and request for a minimum deposit of 10-20%. It can be useful for the financier to seek out the lending institutions that need minimal deposit options to lower these details their money to close. There will certainly also be the typical title costs connected with shutting a deal.

See to it to talk to the difficult cash loan provider to see if there are prepayment charges billed or a minimum yield they need. Presuming you are in the car loan for 3 months, and the residential or commercial property markets for the predicted $180,000, the capitalist makes a revenue of $25,000. If the home costs more than $180,000, the customer makes more cash.

Since of the shorter term as well as high rates of interest, there normally requires to be restoration as well as upside equity to record, whether its a flip or rental home. Initially, a hard money financing is optimal for a customer who intends to take care of and turn an undervalued residential property within a relatively short period of time.

What Does Hard Money Atlanta Do?

It is vital to understand how difficult cash financings work and also how they differ from conventional fundings. These traditional lending institutions do not usually deal in tough cash car loans.

The Hard Money Atlanta Statements

When using for a hard money lending, debtors require to show that they have find out sufficient capital to successfully obtain with a bargain. (ARV) of the property that is, the estimated value of the residential or commercial property after all renovations have actually been made.Report this wiki page